Slowing Housing Market Sees Capital City Values Fall Below Their Peak

- Vexar Property Group

- Mar 18, 2019

- 3 min read

With dwelling values now falling across most capital cities, the topic at weekend BBQs across the country might very well be, what’s next for Australia’s property market?

Corelogic's latest models show, at least for the short-term, that values are likely to continue trending lower, with the rate of decline easing later this year and into 2020.

National housing market downturns have generally been short-lived. Although, the current downturn of 16 months is now the second longest, with the 2010-12 decline running two months longer than the current downturn.

By next month, assuming the falls continue, Corelogic says this will be the largest downturn in the combined capital city index since 1980.

There is an expectation that interest rates may move lower. This week a report from the Reserve Bank cited shifting interest rates as responsible “more than any other factor”, for weakening house prices and construction rates.

“We probably won’t see the entire rates cuts passed through to mortgage rates and the much tighter credit conditions are likely to limit any rebound in the housing market,” Corelogic said.

“Particularly given borrowers are being assessed on their ability to repay a mortgage at a much higher rate, above 7 per cent.”

SYDNEY

Since peaking in July 2017, Sydney's dwelling values have fallen by 13.2 per cent to February 2019.

Corelogic says this is one of the longest periods of decline.

“With little sign that the falls will abate over the coming months, this current downturn may end up being the deepest and longest in modern times.

“This downturn is also very different to other downturns which have generally been driven by an economic contraction or higher interest rates.

“This downturn is more closely linked to a significant tightening of credit conditions at a time in which the economy continues to grow and interest rates are unchanged - despite some moderate increases for owner occupiers and larger rises for investors.”

MELBOURNE

From Melbourne’s housing market peak in November 2017 through to the end of last month, dwelling values across the city have dropped by 9.6 per cent.

“Interestingly, comparing the downturn in Melbourne to Sydney, 15 months into Melbourne’s downturn values have fallen 9.6 per cent compared to a decline of 8.2 per cent 15 months into Sydney’s downturn.

“The downturn in Melbourne’s housing market is closing in on its largest downturn of 10 per cent between 1989 and 1992 while the downturn (so far) has been much shorter than the 36 month period in 1989-92.”

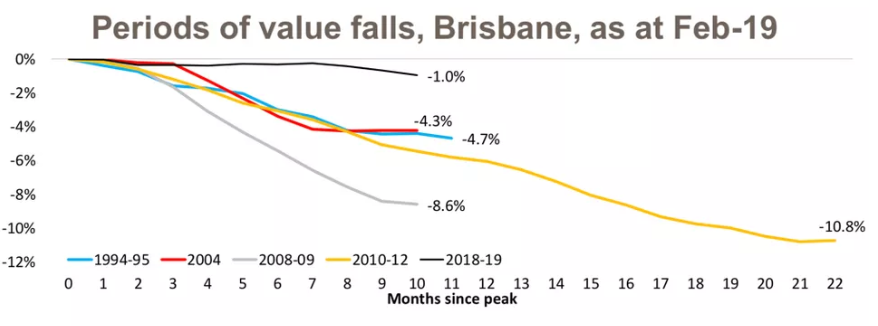

BRISBANE

Brisbane didn't experience the great upswing in property prices recorded in Sydney and Melbourne in recent years. And as such, after experiencing moderate growth the data shows Brisbane is recording a moderate decline.

Brisbane’s property values peaked in April 2018, dropping 1 per cent to February 2019.

“To date the fall is moderate however, with housing market weakness entrenched values are expected to move slightly lower or, at best hold firm, over the coming months.”

PERTH

Following the slowdown in the mining sector, Perth’s housing market has experienced an extended downturn since June 2014 when the market last peaked. Perth’s property values have fallen by 17.8 per cent since then.

“The current downturn has run substantially longer than previous downturns and it is also a much deeper value fall than recorded across previous downturns,” CoreLogic said.

“In late 2017/early 2018 it was looking as if the falls were coming to an end, however, the market has weakened further in line with weaker labour market and economic conditions as well as tighter credit conditions.”

ADELAIDE

Much like Brisbane, Corelogic says Adelaide’s growth has been moderate over recent years however, with values starting to decline over recent months.

Adelaide’s values peaked in December 2018, recording a fall over the past two months of 0.3 per cent at the end of February 2019.

“While there have been previous periods of value falls in Adelaide, they have tended to be more moderate than those recorded across the other capital cities.

“To-date the decline has been short and moderate and it will be interesting to see over the coming months whether values continue to fall.”

Written by TUD Journalist Original article: https://theurbandeveloper.com/articles/slowing-housing-market-sees-most-capital-city-values-fall-below-their-peak-corelogic?utm_medium=email&utm_campaign=180319%20QLD&utm_content=180319%20QLD+CID_8856d6f5210560d1b887599f5089e75d&utm_source=email&utm_term=Continue%20Reading

Comments